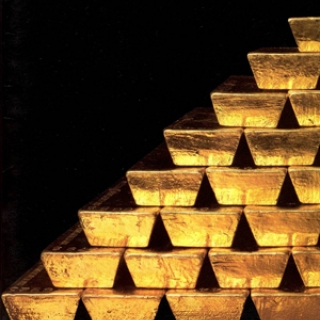

Gold held above $2,640 an ounce on Wednesday as markets continued to assess the political and monetary outlook, while closely monitoring key economic data releases.

A recent report showed that U.S. job openings were higher than expected, indicating continued resilience in the labor market.

Investors now look ahead to Friday's anticipated nonfarm payrolls report, along with additional speeches from several Fed officials to gauge the central bank's potential policy moves this month.

The odds for a 25bps rate cut in the federal funds rate currently stand at 73%, which benefits gold by reducing the opportunity cost of holding the non-interest-bearing asset.

Meanwhile, the metal remains supported by its safe-haven appeal amid political uncertainty in South Korea and France, as well as ongoing geopolitical tensions in the Middle East and the Russia-Ukraine war.

Source: Trading Economics

Gold prices briefly caused a stir after hitting a new record, but then slowed. The main trigger: US President Donald Trump withheld the threat of tariffs on Europe and claimed there was a "framework" ...

Gold prices hit another record high, while silver held near its all-time high. This rise was driven by two major factors: the escalating Greenland crisis and turmoil in the Japanese government debt ma...

Gold prices remained near all-time highs on Tuesday, hovering around $4,670 per ounce. Demand for safe haven assets remained strong as US-European trade tensions escalated, prompting investors to refr...

Gold and silver hit new records after US President Donald Trump threatened to impose tariffs on eight European countries that oppose his Greenland plan. This situation immediately pushed investors int...

Gold price rises on Friday, poised to end with weekly gains of nearly 4% as an employment report in the US was mixed, with the economy adding fewer jobs than projected. Still, the Unemployment Rate ti...

Gold prices briefly caused a stir after hitting a new record, but then slowed. The main trigger: US President Donald Trump withheld the threat of tariffs on Europe and claimed there was a "framework" for a future agreement on Greenland. This calmer...

Oil prices were little changed in Asian trading on Thursday after US President Donald Trump backed down from a threat to impose tariffs on European countries over Greenland. This decision helped ease geopolitical tensions and improve market...

The Nikkei 225 Index climbed 1.73% to close at 53,689, while the broader Topix Index rose 0.74% to 3,616 on Thursday, snapping a five-day losing streak as Japanese shares were lifted by a strong rally in chip and artificial intelligence related...